The Goodyear Sustainability Reality Survey for the UK and Ireland shows an ongoing trend towards sustainability

Goodyear’s Annual Sustainability Reality Survey Reviewed

Goodyear says that it is seeing a positive evolution. Trends observed in 2022 have carried over to 2023. One result is that fleets seeing sustainable measures as a way to reduce operating costs have risen from 41 to 50 per cent in 2023.

The size of the fleet is a driver towards sustainable transport. The larger fleets of over 500 vehicles are leading the way, with 74 per cent having implemented sustainability measures. This is a change also seen in fleets of over 250 vehicles.

Looking at the responses for recognising sustainability as necessary, there is greater emphasis on sustainability in the larger fleets. One might expect that larger, more stable fleets have the luxury of focusing on sustainability, whilst smaller fleets might be more concerned about their next contract.

According to the Goodyear survey, the most significant driver for sustainability was corporate values or concern for climate change, with 67 per cent of respondents making that claim, whilst only 23 per cent said that reducing operating costs was the driver. Seven per cent were clear that it was now a requirement to win new business – which relates to the corporate values response across the whole economic sector. However, three per cent said they were not concerned about Environmental Sustainability.

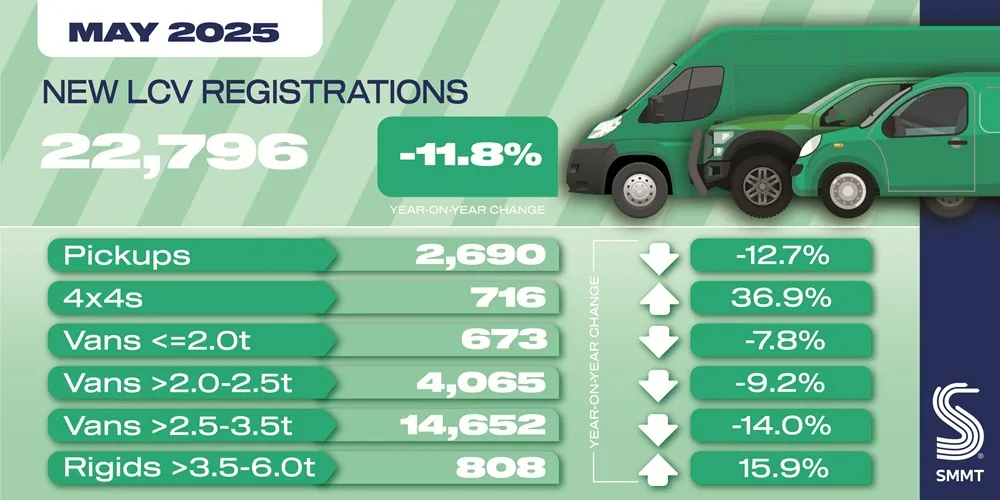

Asked how fleets were approaching their sustainability goals, 43 per cent said they were renewing their vehicles, and 67 per cent were using more fuel-efficient tyres. Then, neck and neck at 64 and 63 per cent, respectively, were driver training and telematics solutions to monitor and reduce fuel consumption. 49 per cent were using retread tyres as part of their solution, whilst 34 per cent were deploying higher capacity vehicles. 36 per cent were looking at alternative powertrains such as electric, hybrid or LNG. This latter figure is somewhat higher than is being shown by SMMT registrations for alternate powertrains, perhaps indicating that the move is one to be anticipated in the near future.

Interestingly, looking at the solutions already in use, the smaller fleets were unique in not using retreaded tyres, which might be a hangover from the outdated perception that retreads are not good quality options. The larger the fleet, the more likely they are to use retreaded tyres as part of their solution. There is a clear trend that the larger the fleet, the greater the emphasis on sustainable operations. However, the message about fuel-efficient tyres has not yet fully penetrated more than half of mid-range fleets that responded.

Asked about formalising sustainability objectives, the larger fleets led the way, with smaller fleets somewhat behind the curve.

In an example of how business often operates on different planes – familiarity with upcoming legislation varied; whilst Goodyear states that 86 per cent of operators consider themselves familiar with upcoming environmental legislation, drilling down shows that smaller fleets with 1 – 10 vehicles show 57 per cent have no familiarity with upcoming legislation. Only the larger fleets with over 500 vehicles consider themselves very familiar at 55 per cent, though 4 per cent did say they had no understanding.

So, what were the barriers to sustainable operations?

It is clear that being sustainable comes at a cost, and there is an irony in that response, given the drive towards more fuel-efficient tyres and reducing costs by increasing vehicle size. However, 54 per cent say that cost is a barrier, 37 per cent say the solutions are too complicated, whilst 31 per cent doubt the efficacy of some of the solutions. 19 per cent say that they don’t have the staff, and another 19 per cent say that some sustainability solutions involve trade-offs they cannot accept. Only 10 per cent said there were no barriers to becoming more sustainable.

Drilling down into those reasons there were some anomalies; for example, whilst it might be expected that smaller fleets don’t have the staff to manage the solution (43 per cent), fleets in the 250 – 500 range also have the same reason (50 per cent) yet small fleets of 11-50 have less of a barrier here (11 per cent) and 51 – 100 (0 per cent).

Yet, regarding complicated solutions, the smaller fleets have less resistance ( 14 per cent), and the larger fleets of 250 – 500 have the highest (80 per cent). Similarly, the cost barrier is less of an issue for the smaller fleets (29 per cent) and highest in that 250 – 500 grouping (100%).

What would move fleets to greater sustainability?

Here, there is a bit of a mixed response. Still, essentially, it has primarily to do with financial benefits, with 72 per cent saying that financial incentives would drive their sustainability – that possibly backed by increased customer demand and increased focus by investors. Two other key drivers could be the availability of solutions that improve sustainability and profit simultaneously and solutions that are easier to use. This latter point is interesting. When visiting a fleet manager, Commercial Tyre Business asked about tyre management some years ago. The subject nodded at a pile of paper, saying, These are last month’s tyre reports for the fleet.” When asked what he did with them, he responded, “I don’t have the time to analyse these, so once a month, I put them in the bin.” With digital tyre management, one might have thought that looking at a fleet tyre report would take much less time, being simplistic, drawing up the fleet data and looking for any red flags. Yet, still, ease of use is a barrier to some 64 per cent of fleets – again, that 250 – 500 fleet size has the highest response here at 90 per cent. Understanding legislation better would be a driver at the lower end of the fleet size. (57 per cent) – although the response to this point varied across the fleet sizes.

It is important to note that this Goodyear survey attracted 74 responses from the UK and Ireland, so it will not be totally representative, and just a handful of large fleets responding would skew the responses, whilst a relatively small number of smaller fleets might well have responded to the same effect. However, as with any survey of this kind, it gives a general indication of how those who are interested and open to discussion are thinking.