In April, UK CV manufacturing saw a 19.9% decline, yet it maintained a 13.6% lead in the first four months. Exports were up by 30.3%, notably driven by the EU market.

Decline in UK Commercial Vehicle Manufacturing Despite Strong Export Growth: April Insights

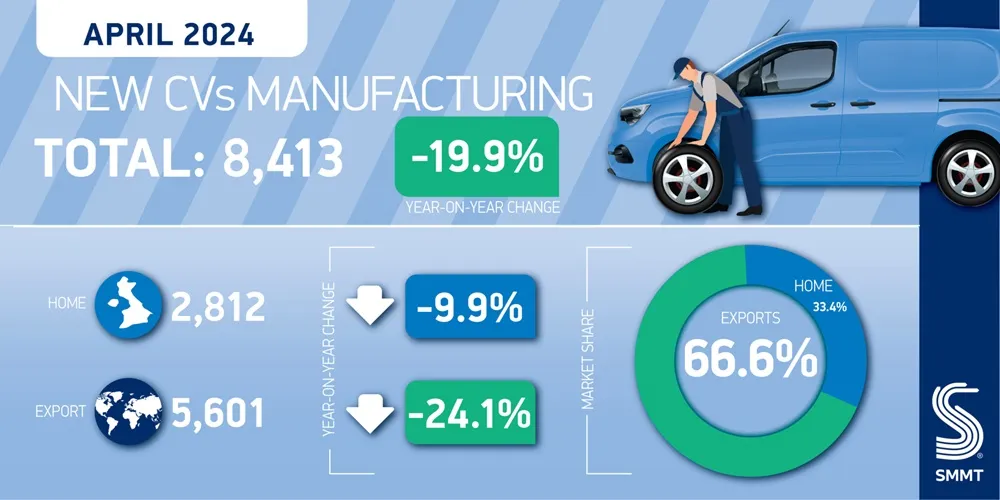

In April, UK CV manufacturing declined 19.9% to 8,413 units, though it maintained a lead of 13.6% in the first four months, marking its best performance since 2010. Despite a downturn in both domestic and export markets by 9.9% and 24.1%, respectively, year-to-date exports showed a remarkable increase of 30.3%. Notably, the EU remains Britain’s largest export market, accounting for 97.1% of exports in the last month.

UK commercial vehicle (CV) manufacturing fell by -19.9% in April, the second consecutive monthly decline, with 8,413 vans, trucks, taxis, buses and coaches rolling off factory lines, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Despite this fall, CV production output is up a staggering 289.1% on the same period in 2019 – given investment and an uncharacteristically low April 2019 with model changeovers at significant production plants.1

Production for export declined by -24.1% in April, with 5,601 units making their way to global markets to represent two-thirds (66.6%) of vehicles produced in the month. The domestic market also saw a fall, albeit at a smaller rate of -9.9%, or just 310 units, a year ago. April’s decline reflects temporary supply chain shortages and market normalisation following high levels of pent-up demand post-Covid.

UK Commercial Vehicle Manufacturing Soars in Year-to-Date Export Performance

Output remains up by 13.6% at 41,039 units – the sector’s best performance since 20102 – driven by robust export demand, up 30.3% on the same period last year. Seven in 10 commercial vehicles produced in the first four months were destined for export, with the EU responsible for the lion’s share at 96.8%. Meanwhile, manufacturing units for UK customers declined by 12.4% to 12,378 units. Still, this figure is expected to rise throughout the year as the market stabilises.

Mike Hawes, SMMT Chief Executive, said, “A second consecutive month of decline for British commercial vehicle production is disappointing, but with supply chain shortages likely to be temporary and BEV production still set to rise, we expect a return to growth in the latter half of the year. However, the sector remains in good health thanks to strong demand from overseas markets. With a general election less than two months away and net zero deadlines looming, we look to the next government to ensure market conditions remain favourable to businesses and manufacturing competitiveness is enhanced so the sector can continue to attract the investment necessary to boost the production of zero-emission vehicles.”