The latest report from the Society of Motor Manufacturers and Traders (SMMT) shows a significant decline in the UK van market in 2025.

Van Market Report by SMMT

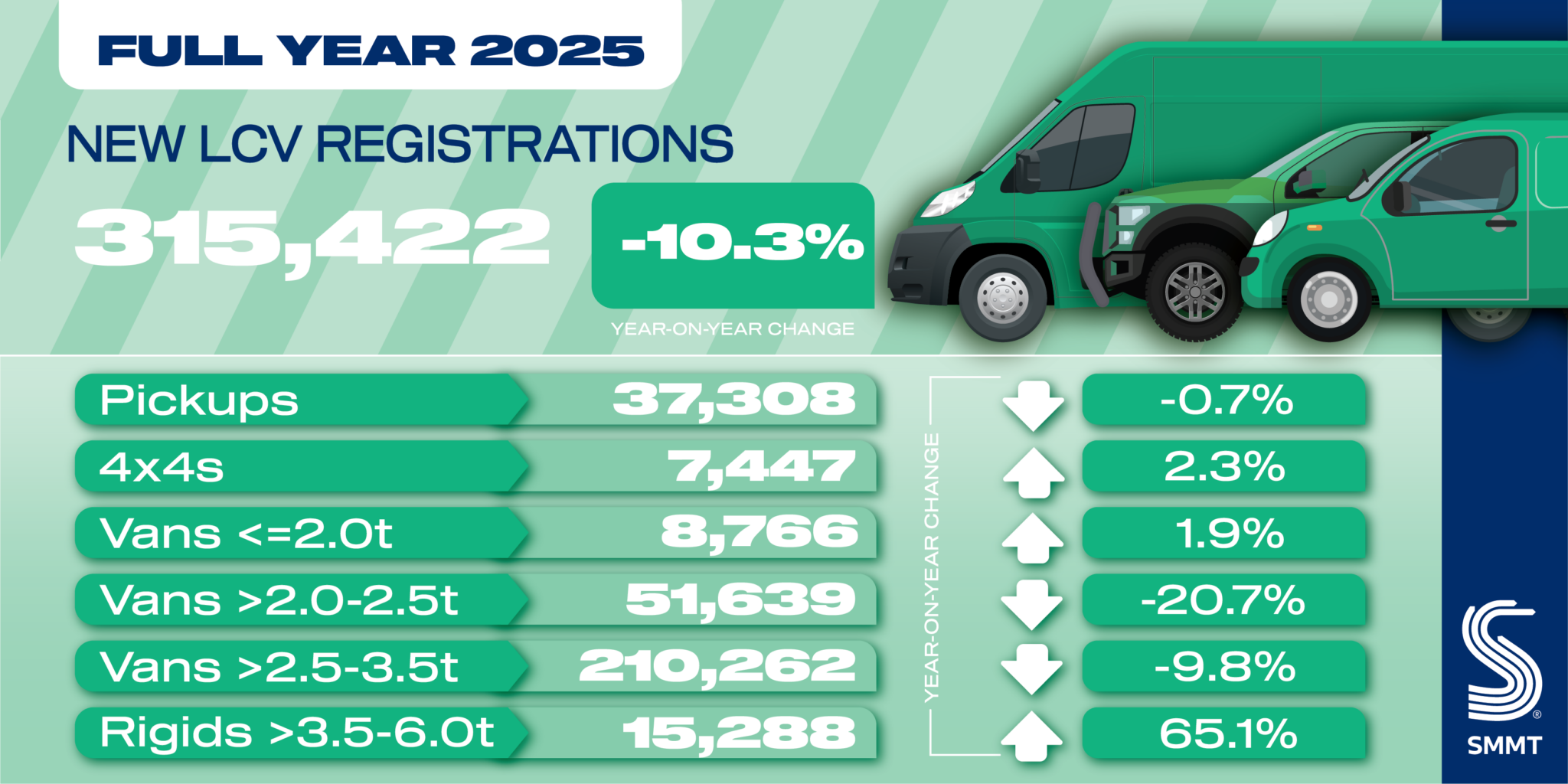

The UK’s new light commercial vehicle (LCV) market declined by 10.3% in 2025, according to the latest data published by SMMT. Fleet renewal declined in every month last year, except December, which had a slight 1.7% rise, reflecting a challenging economic environment and weak business confidence.

Registrations of new medium-sized vans declined by 20.7% to 51,639 units in 2025, while large vans dropped by 9.8% to 210,262, but remained the most popular segment with a 66.7% share of the overall market in the previous year. Pickups also ended the year down, by 0.7% with 37,308 registrations, despite growth in early 2025 to get ahead of the government’s tax change, which now treats double cabs as cars for benefit-in-kind and capital allowance purposes. There was growth in the lower-volume segments, with registrations of small vans and 4x4s up by 1.9% and 2.3% respectively, to 8,766 and 7,447 units.

On a more positive note, deliveries of new battery electric vans (BEVs) grew by an impressive 36.2% with 30,169 registrations, representing a new annual record. The growth represents a significant achievement in a contracting overall market, due to the massive industry investment aiming to provide more than 40 different zero-emission van models, representing more than half of the new model choices.

Despite this offering, manufacturers still had to subsidise the sale of their cutting-edge innovation to bridge the gap between mandated ambition and real-world demand, with almost £400 million in discounts in 2025. The 2025 EV market share stands at only 9.5%, however, well short of the 16% mandated for the year, reflecting a clear gap between ambition and reality.

Critical barriers are still there, including higher production costs, a paucity of van-suitable public charging and lengthy waiting times for depots to get connected to the grid. The extension of the Plug-in Van Grant, the new Depot Charging Scheme and proposed planning reform for private charger installations will help, but the steep rise in mandated ambition to 24% in 2026 will require further action. An urgent review of the transition is essential, ensuring the regulation and support measures deliver the required demand without undermining the industry’s viability. With changes taking place in the EU, the US and elsewhere, the UK market must remain healthy to safeguard its investment appeal.

Mike Hawes, the CEO of SMMT, commented: “2025’s new van market reflects a tough economic environment, which constrained fleet investment. While rising EV uptake is encouraging, it has come at a huge cost to industry and remains significantly adrift of ambition. Government’s upcoming review must acknowledge the unique challenges facing the light commercial vehicle sector and the additional action required, else the gap between market regulation and reality will continue to widen.”