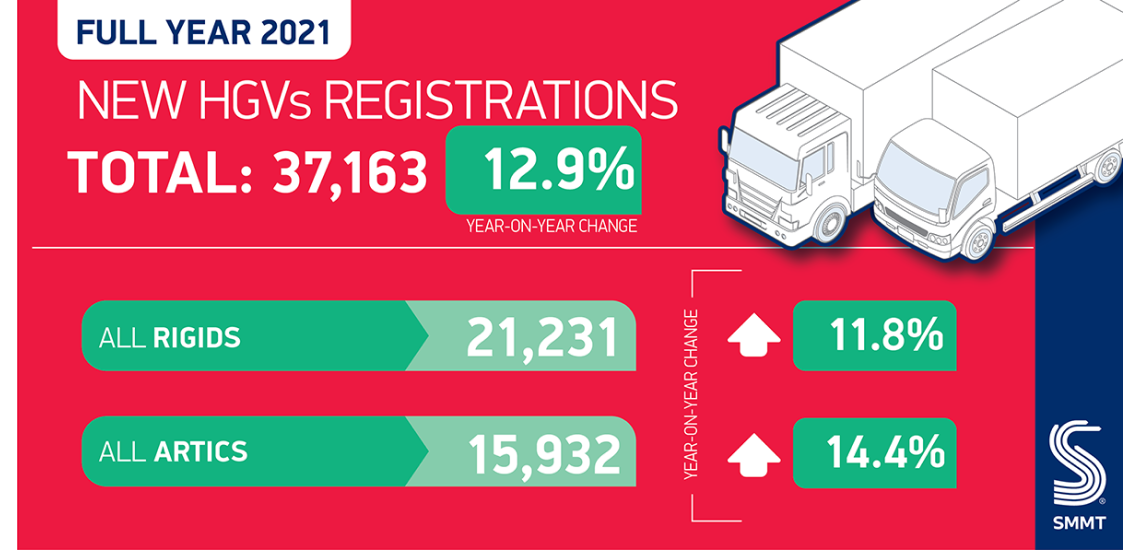

UK HGV registrations for 2021 have defied expectations with a 37,163 increase on 2020 levels, amounting to a 12.9% increase. With supply chain constraints continuing to stiffen the market, this still indicates that the market is not at levels of the pre-pandemic average, with a 16.9% falls in figures released by the Society of Motor Manufacturers and Traders (SMMT).

Industry Renews Calls for Transmission to Zero-Emission Vehicles to Maintain Fleet Operator Confidence

With the end-of-year figures in, the market held tight over 2021. Growth in key industry sectors such as construction saw dem...

Industry Renews Calls for Transmission to Zero-Emission Vehicles to Maintain Fleet Operator Confidence

With the end-of-year figures in, the market held tight over 2021. Growth in key industry sectors such as construction saw dem...