BIL Sweden, the Swedish Association for Manufacturers and Importers of Cars, Trucks and Buses published its monthly registration figures for the market with year-to-date figures continuing to perform strongly across the truck sector for both light and heavy trucks, contrasting significantly to the struggling bus sector.

HCV Sales 14% Up on August 2020 Figures and Show 14% Increase in Year-to-Date Numbers

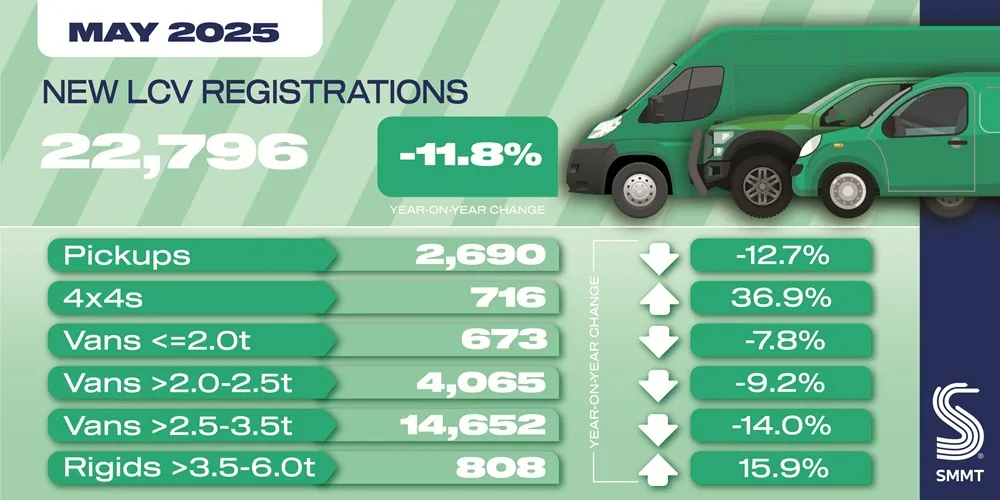

The sales of light commercial vehicles, vehicles under 3.5 tonnes in Sweden has been one that has fluctuated significantly according to the association with 8,700 LCVs registered in April 2...

HCV Sales 14% Up on August 2020 Figures and Show 14% Increase in Year-to-Date Numbers

The sales of light commercial vehicles, vehicles under 3.5 tonnes in Sweden has been one that has fluctuated significantly according to the association with 8,700 LCVs registered in April 2...