According to the latest SMMT report, new heavy goods vehicle (HGV) registrations declined by -14.5% in quarter three as fleet renewal continues to normalise.

The Latest HGV Market Data by SMMT

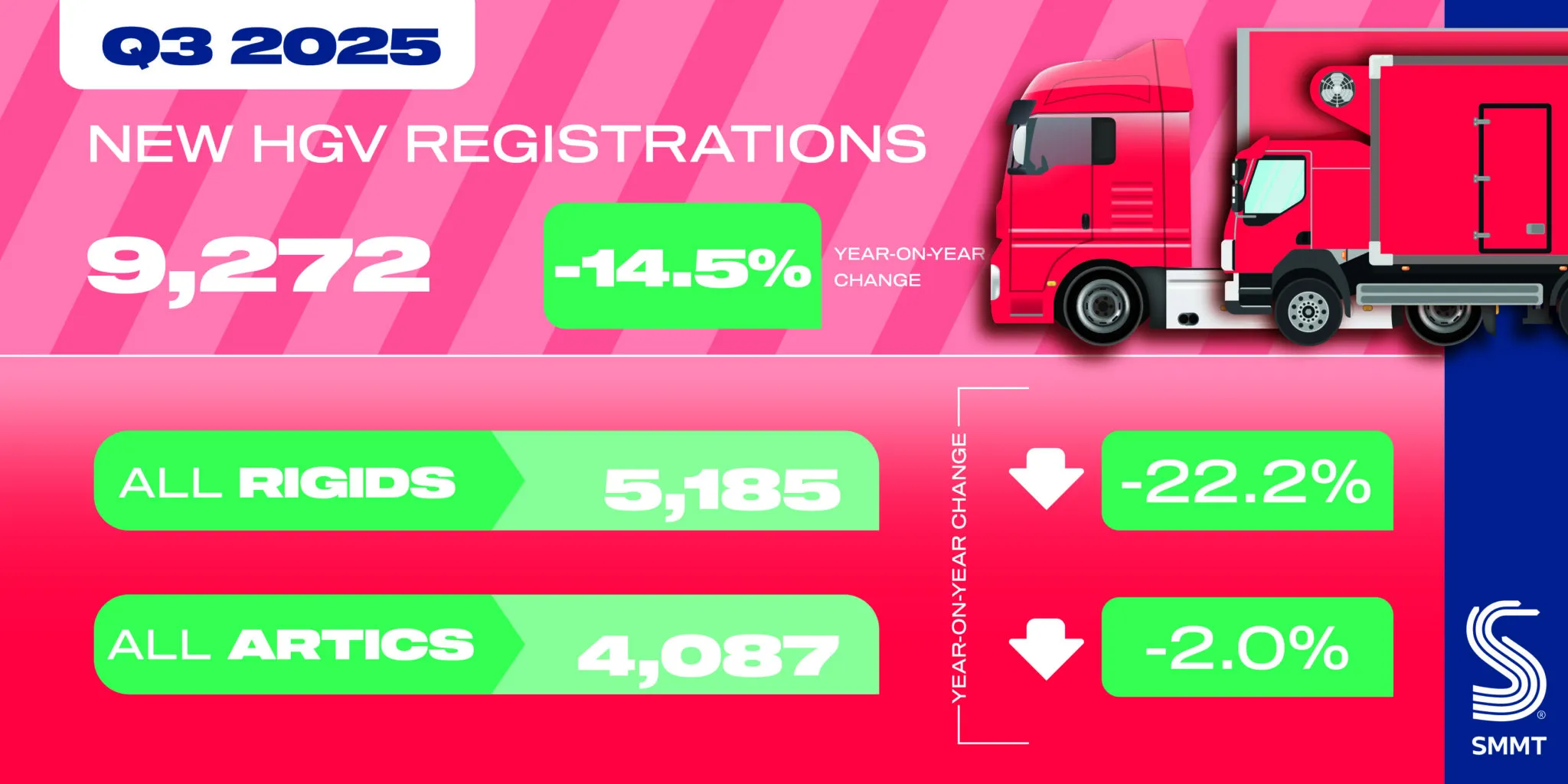

HGV registrations declined by -14.5% in the third quarter of 2025, with 9,272 new trucks registered in the UK, according to the Society of Motor Manufacturers and Traders (SMMT). The market’s fifth consecutive quarterly decline, with a 12.5% drop in 2025 to date, comes amid a challenging economic backdrop. However, it also reflects the natural ebb and flow of fleet renewal cycles following three years of sustained post-pandemic growth.

The decline included reduced demand for tractor units, down by -2.2% to 3,966 units – but still representing two-fifths (42.8%) of the market – while the box van registrations segment saw the largest volume decline, falling by -38.7% to 899 units. The conventionally lower volume tipper and curtain-sided segments also declined by -10.1% and 38.1% to 712 and 606 units, respectively. There was growth, however, with demand for new refuse disposal trucks up 9.5% to 578 units – albeit representing the market’s smallest segment in the top five.

Zero-Emission HGV

On the other hand, the zero-emission HGV market continues to grow, quadrupling by 341.2% to 225 units in Q3, a new record volume, and also achieving a record 2.4% market share. The significant quarterly demand has driven year-to-date ZEV volumes to 408 units, up 145.8% compared with the same period in 2024. This represents a significant achievement which reflects Britain’s position as Europe’s second-largest zero-emission HGV market by volume. The success has been driven by an impressive product rollout with more than two dozen models now available covering a wide range of operator needs, and the market could grow faster with the right support.

Access to ZEV charging and refuelling infrastructure, in particular, is a key challenge for depot-based operators given grid connection waits of up to 15 years. Industry welcomed the government’s Depot Charging Scheme announced in July to help more operators fund the switch, but timely infrastructure delivery requires prioritisation of HGV depots for grid connection rollout – benefiting from the fast-tracking processes already afforded to data centres, wind farms and solar projects. With a clear route toward ZEV and infrastructure investment, operators who already face tight margins will be more confident to decarbonise their fleet, which is fundamental to the country’s Net Zero ambitions.

Mike Hawes, Chief Executive of SMMT, commented: “New HGV uptake continues to normalise amid a tough economic backdrop so while another quarter of decline is unsurprising, returning to growth is important to keep businesses moving via the very latest, greenest models. Industry continues to invest significantly in zero emission rollout, and rising operator uptake is positive – but more substantial volume growth depends on infrastructure rollout. Fast-tracking depot grid connections, in particular, is critical to help operators plan and invest – and for manufacturers to continue delivering the green growth Britain needs.”